Americans are a rapidly aging population.

In 2019, about 16.5% of population was 65 years old or over; a figure which is expected to reach 22% by 2050. This is a significant increase from 1950, when only 8% of the population was 65 or over. (Statista)

For elderly people who can no longer fully care for themselves, there are four types of residential facility they can consider moving into:

- Assisted living facilities.

- Nursing homes.

- Board and care homes.

- Continuing care retirement communities.

This post is on assisted living facilities (ALF).

ALFs differ from nursing homes in two ways (U.S. News & World Report):

- How to pay: Whereas Medicaid does cover nursing home care as states are required to do so under federal law, some assisted living facilities do not accept Medicaid and are private-pay only.

- Cost: Nursing homes are prohibitively expensive. They can cost up to $11,000 a month in Florida and $16,000 a month in New York.

- Level of care: Unlike nursing homes, assisted living is for those who, for the most part, can still take care of themselves but require some help with daily care, such as house cleaning, laundry, cooking, bathing or showering, medication management, transportation to medical appointments or stores. Residents pay for the level of care they receive: the more care, the higher the cost.

There are 811,500 Americans residing in assisted living, the majority of whom are age 85 and older, female, and non-Hispanic white. More than half of all assisted-living residents have high blood pressure; 4 in 10 have Alzheimer’s disease or other senile dementias. After a median stay around 22 months, about 60% of residents will move out of assisted living to a skilled nursing center. (AHCA/NCAL)

Below is from Sixty&Me:

The average cost per year of assisted-living facilities nationwide is $51,600. Although studies indicate the average person spends nearly 2.5 years (29 months) in an ALF, the average person also spends approximately 2 years and 4 months in a nursing home where the national annual cost is $93,075 for a semi-private room and $105,850 for a private room.

This means that the average person requires from around $342,000 to $372,000 to cover their long-term care costs. But according to Pension Capital, the average retirement fund of Americans is just over $382,000 — enough to pay for around 6 years in assisted living, or 4 years in a semi-private room in a nursing home.

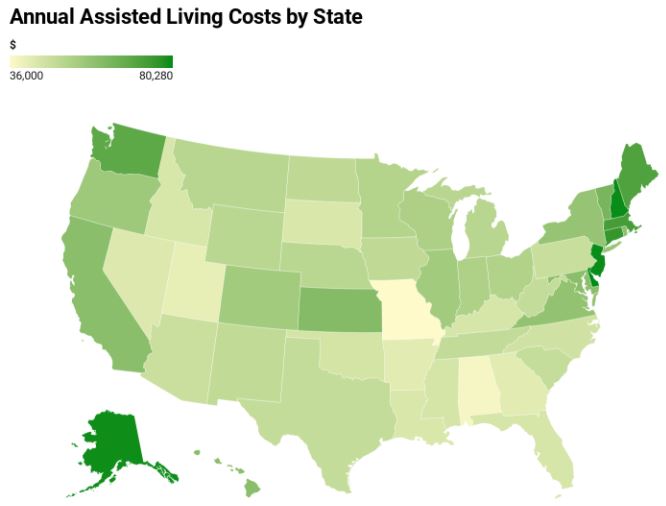

The cost of assisted living can differ by as much as $40,000 between the most expensive and least expensive states.

The 5 most expensive states are:

- Delaware: $80,280 a year.

- New Hampshire and New Jersey: $79,800/yr.

- Alaska: $79,590/yr.

- Connecticut: $75,600/yr.

- Massachusetts: $73,020/yr.

The 5 least expensive states are:

- Missouri: $36,000/yr.

- Alabama: $37,800.

- Utah: $40,800.

- Arkansas and Georgia: $42,000.

- Nevada: $43,140.

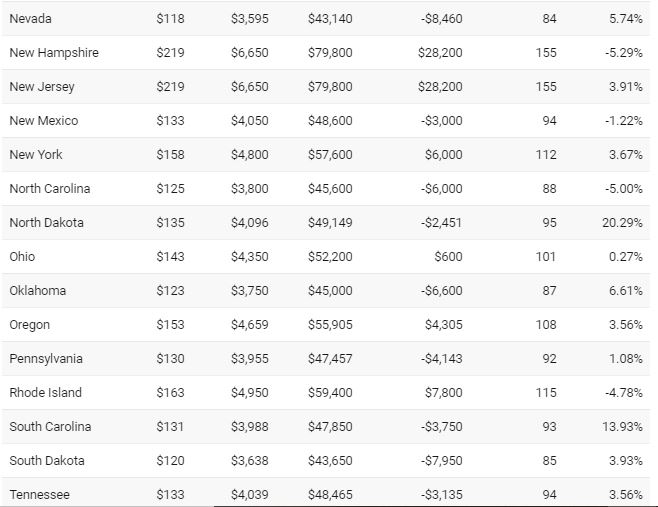

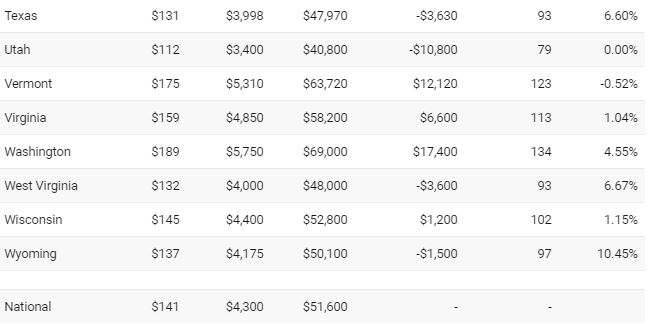

Below are the annual costs of assisted living by state:

~DrE

Drudge Report has gone to the dark side. Check out Whatfinger News, the Internet’s conservative frontpage founded by a military veteran!

These statistics are nothing short of sobering. Even if you are a person who is not particularly bright–the idea comes thru that as a country, we cannot afford to “house” all of the elderly that will be needing care during the last years of their lives. I can only hope that I will be called home long before I will need Assisted Living or Nursing Home residency. The medical advances that we as a people have enjoyed have been marvelous . . . but now we are faced with the specter of outliving our savings and what our pensions and Social Security income will actually pay for in the last days of our lives.

I see another horrific problem for younger Americans–what with all the borrowing our government has done, there is no doubt but what taxes MUST be raised to pay this indebtedness. This means that younger citizens will have less and less income to actually put away for their old age.

This is really an excellent article, and information that everyone needs to become acquainted with. Well done, Dr Eowyn!!!!!

I’ve been researching this for years b/c I originate from “back East” and want to get out of the West for my old age: I love the statistics from, for instance Georgia, Alabama, Arkansas, Utah, Nevada….but then PLEASE everyone, research, too, the number/availability of assisted living spots available in these places…they are few and far between. You have a ghost of a chance of accessing a place for your elderly charge in any of these states b/c there is a dearth of services for the elderly in these states. Search carefully for named resources in order to access true up-to-date availability.