As a result of its political divisions, the United States appears to now be dividing itself into prosperous, high-growth states and states that are suffering a chronic decline….

Caterpillar and Citadel, which announced their exit from Illinois in June, are only the latest firms to leave high-tax, high-regulation states. Tesla, Hewlett-Packard, Oracle, and Remington are also among the hundreds of companies flocking out of California, Illinois, New York, and New Jersey to business-friendly places such as Texas, Florida, Arizona, and Tennessee. Relocating companies have spanned industries including tech, finance, media, heavy manufacturing, autos, and firearms.

“There is a great migration going on, and I expect it to accelerate,” Glen Hamer, president of the Texas Association of Business, told The Epoch Times. “When the Caterpillars and the Elon Musks relocate, it’s an advertisement to the entire country and the entire world that something positive is going on in that state. And there is a multiplier effect.”

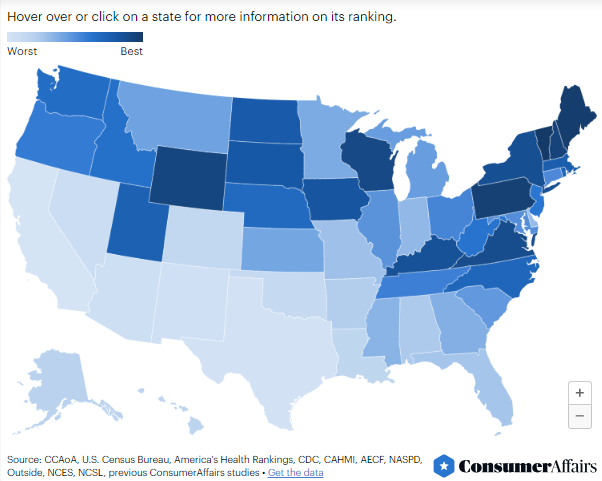

According to a 2022 survey of 700 CEOs, the top states for business are Texas, Florida, Tennessee, Arizona, and North Carolina. The worst states for business were California, New York, Illinois, New Jersey, and Washington.

Even companies such as Apple, which didn’t move its headquarters to Texas, chose to establish its second-largest campus for employees there. Amazon selected Houston as one of its prime hubs. Ford, Volkswagen, and Nissan chose Tennessee as the location for major new manufacturing facilities. And in some cases, entire industries, such as firearms, which are being targeted by legislation and lawsuits in blue states, are moving south….

When jobs leave, people leave with them. According to the U.S. Census, Democrat-run states California, New York, New Jersey, Michigan, and Illinois together lost 4 million people between 2010 and 2019, the so-called leftugees. During the same period, the states with the greatest influx of people were Florida, Texas, Tennessee, Ohio, and Arizona….

Florida attracted 624,000 new residents in 2020, along with more than $40 billion in income, equating to an estimated $23.7 billion in new tax income. Florida has enjoyed two decades of net in-migration, amounting to a total income gain of $197 billion….

According to a report based on IRS data by Wirepoints, an Illinois-based economic research organization, the cost of losing companies and people is stark for states such as Illinois, which has seen decreases in its population for 21 straight years.

Since 2000, that state has lost a total of $535 billion in income that moved away, which equates to about $25 billion in lost tax revenue during that period, and $4 billion in 2020 alone. Illinois’ problems include a loss of 114,000 residents in 2021, a string of 21 consecutive years of state budget deficits, a $313 billion deficit in public pensions, and the second-highest property tax rates in the country.

“Illinois is stuck in a vicious downward spiral it can’t hope to escape from without fundamentally changing how it governs,” the Wirepoints report reads. “Structural property tax reform, reductions in pension debt, slashing units of local government—the state needs to do all these things if it wants to convince Illinoisans to stay and persuade other Americans to move in.”

Reducing violent crime would also help. Escalating crime was reportedly a factor, one among many, in Citadel’s decision to leave Chicago for Miami.

This exodus has many consequences and implications, one of which is the hardening of the Left-Right division in America as blue states get even bluer with the loss of conservative voters, while red states get redder with the addition of conservative escapees.